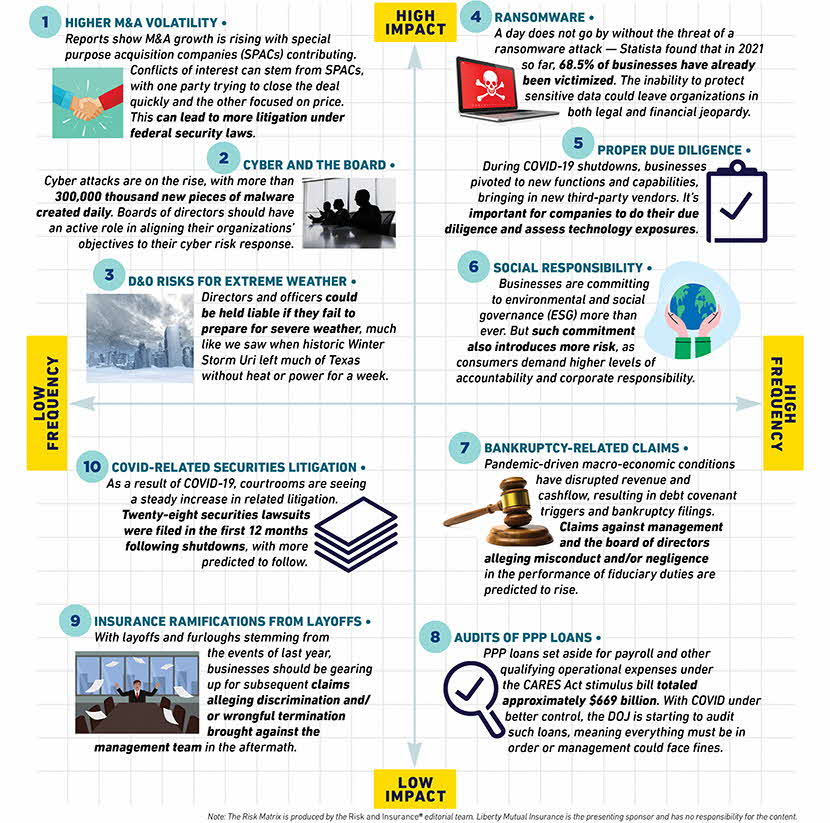

From cybersecurity exposures and ransomware attacks to M&A volatility and securities litigation, a variety of evolving professional lines risks are affecting the management and professional liability market as the economy adapts in response to COVID-19.

The Professional Lines Risk Matrix featuring 10 potential exposures affecting the professional lines market.

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots 10 areas that businesses should address to mitigate professional lines-related risks, based on frequency and severity.

Download the Risk Matrix

Higher M&A volatility

One pandemic-era risk trend that continues to affect markets is the rise of mergers and acquisitions (M&A). Morgan Stanley reported that last quarter saw 1,250 M&A deals globally, totaling more than $1 trillion. Contributing to the economic landscape are special purpose acquisition companies (SPACs), businesses expressly created to take other companies public and avoid the traditional IPO process. With SPACs, there can be a conflict of interest, with one party trying to close the deal quickly and the other party focused on price. This conflict is leading to more litigation under federal security laws.

Cyber and the board

In 2021 so far, 68.5 percent of businesses have already been victimized by ransomware, according to Statista. And with more than 300,000 new pieces of malware created daily, now is the time for boards of directors to address cyber risk needs. And for good reason: cyber risks are about more than private data; they imperil core operational functions and strategic objectives. It’s never too early to get the board invested in cyber risk management.

D&O risks for extreme weather

Severe weather events can push systems to their limit. When those systems fail, businesses and municipalities may be liable for claims relating to property damage, business interruption, and even loss of life. Directors and officers could be held liable if they fail to prepare for severe weather, much like we saw when historic Winter Storm Uri left portions of Texas without heat or power for a week. Government and municipalities can mitigate potential directors and officers’ (D&O) exposures by conducting their due diligence. Taking actions like staying up to date on climate data, evaluating and upgrading their current capacities against system failure, and having a continuity plan for emergencies can help organizations reduce their risk and keep the public safe.

Ransomware

The threat of ransomware attacks is becoming more common—in 2021 so far, 68.5 percent of businesses have already been victimized by some type of attack. Digital connectivity is unavoidable for businesses as more turn to computers and online systems to get the job done. The inability to protect sensitive data could leave organizations in both legal and financial jeopardy and goes beyond just cyber exposure. For example, when a ransomware attack occurs at a healthcare facility, both patients and hospital operations can be impacted, resulting in medical malpractice, product liability, and billing errors, and other regulatory liability concerns.

Proper due diligence

For more than a year, businesses across sectors pivoted to new functions and capabilities to keep up with the rapidly evolving economic landscape. While many pandemic-related restrictions are being lifted, the post-COVID-19 world poses a new set of risks that organizations will need to address. Whether companies are welcoming employees back to the office, entering into new vendor partnerships, or evaluating their geographic footprints, they need to do their due diligence and assess the potential exposures.

Social responsibility

Businesses are committing to environmental and social governance (ESG) more than ever before because consumers are looking to engage with corporations that take into account their impact on society at large. How a company treats its employees, addresses top-tier societal issues, and responds to current events can have a significant effect on overall performance. But if a company fails to follow through on its promises, it can expose itself to a variety of risks—loss of shareholders, employees, reputation and revenue can stem from poor ESG performance.

Bankruptcy-related claims

With 2020 going down in history as the “year of COVID-19,” D&O inquiries and related claims continue to be at the forefront of many organizations’ minds. Pandemic-driven macro-economic conditions have disrupted revenue and cash flow, resulting in debt covenant triggers and bankruptcy filings. Boards should be prepared for potential litigation arising out of such actions, and claims made against management alleging misconduct and/or negligence in the performance of fiduciary duties are predicted to rise.

Audits of PPP loans

In response to economic instability caused by the COVID-19 pandemic, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. A key part of that act was the Paycheck Protection Program, or PPP, a low-interest loan backed by the Small Business Association (SBA) that would help businesses cover payroll and other operational expenses. As of May 31, 2021, the SBA has given out more than $800 billion in PPP loans. And while most PPP recipients used their loans to stay afloat and support their workforce, some business owners used that money inappropriately. Now, the Department of Justice (DOJ) is beginning to look more closely at how these funds were being used. A business under investigation may look to its D&O insurance policy for support—but it doesn’t necessarily provide coverage in fraud-related government investigations.

Insurance ramifications from layoffs

Click here for the rest of the story…