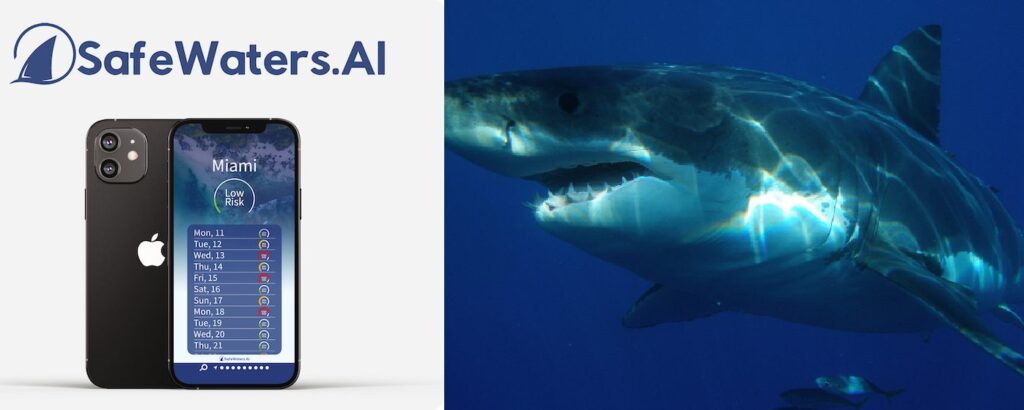

Shark Attack App Uses AI to Forecast and Detect Risk for Swimmers at 89% Accuracy

A sophisticated app generates shark attack “forecasts” using artificial intelligence.

GoodNewsNetwork.org | By Andy Corbley | May 19, 2023 | Shark Attack | Boat Insurance

The developers are taking advantage of a deep learning algorithm to compartmentalize over a hundred years of shark attack data to create a sort-of weather forecast for beaches around the US with an 89% accuracy.

Called SafeWaters.AI, they hope not only to save lives—their primary objective—but to help reduce the persecution of sharks in response to attacks on humans.

Shark Attack Risks

The risk of shark attack is about 1 in every 3.7 million swimmers, and 60% (28) of all recorded shark attacks in the US have occurred in Florida.

As the developers point out, most consumers of news regarding AI see it employed for aspects that seem frightening or purely futuristic, such as deep fake video creation or self-driving cars.

But the ability of a targeted AI to parse out trends and forces in mountains of data lends it to working with all manner of unique applications. In this case, over a hundred years of shark attack reports are analyzed, with data points being whether it was a swimmer or surfer, where the victim was swimming, what time of day it was, what the marine weather conditions were like, and even whether they were wearing shiny jewelry.

credit SafeWaters AI

In an era where artificial intelligence is progressively transforming our daily lives, a groundbreaking app, SafeWatersAI, has arrived. This innovative application, which has recently launched its crowdfunding campaign on Kickstarter, revolutionizes our interaction with marine environments. SafeWaters forecasts the risk of shark attacks with an impressive 89% accuracy rate. You can say it’s like a weather app, for sharkiness.

All of this contributes to the total percentage risk displayed on the app.

Currently, the project is being crowdfunded, with 5% of all future sales to be donated to ocean cleanup efforts.

Click here to read the full article and see some great photos…