Beyond the Basics: Uncovering Hidden Health Insurance Benefits

Many people view health insurance as solely covering doctor visits, prescriptions, and emergencies. However, your health insurance plan might offer a wider array of benefits than you expect, potentially saving you money and supporting a healthier lifestyle. Here are a few benefits that might be hiding in your health insurance plan:

- Gym Memberships and Fitness Discounts: Many plans offer incentives for maintaining a healthy lifestyle. This can include discounted gym memberships or reimbursements for fitness programs.

- Dietitian and Nutrition Counseling: If you’re looking to improve your diet or manage a health condition through nutrition, your plan might cover sessions with a registered dietitian.

- Mental Health and Wellness Support: Beyond traditional therapy, some plans include coverage for mental health apps, stress management programs, or mindfulness classes.

- Alternative and Complementary Treatments: Depending on your plan, you might find coverage for services like acupuncture, chiropractic care, or massage therapy.

- Preventive Screenings and Wellness Checks: Most plans cover a wide range of preventive services, often at no cost to you. These can include annual physicals, immunizations, and various screenings for early detection of health issues.

- Smoking Cessation Programs: If you’re looking to quit smoking, your health insurance may cover counseling, medications, or other support programs to help you achieve your goal.

- Maternity and Postpartum Care: Beyond standard prenatal and delivery services, some plans offer extended postpartum support, lactation consulting, or even classes for new parents.

Mental Health Parity: What You Need to Know

The Mental Health Parity and Addiction Equity Act (MHPAEA) of 2008 is a landmark piece of legislation that ensures your health insurance coverage for mental health, behavioral health, and substance use disorders is on par with coverage for physical health. This means that most health plans, including those offered through the Health Insurance Marketplace, are legally required to cover mental and substance use services.

What Does MHPAEA Cover?

MHPAEA mandates that if your plan covers medical and surgical benefits, it must also cover mental health and substance use disorder benefits with the same level of care. Services typically covered under MHPAEA include:

- Counseling and Therapy: This can encompass individual, group, and family therapy sessions.

- Medication Management: Appointments with prescribers for mental health medications.

- Inpatient Treatment: Hospital stays or residential programs for more intensive care.

- Substance Use Treatment: Services dedicated to addiction recovery, such as detoxification and rehabilitation.

- Outpatient Care: Programs that provide structured support without requiring an overnight stay.

It’s always a good idea to review your specific health insurance policy or contact your provider directly to understand the full scope of your benefits. You might be surprised by what’s available to help you live a healthier, more balanced life.

Where to Find These Benefits

Want to take advantage of some of these benefits? You’re most likely to find out eligibility in one of the following ways:

- Employee benefits portals: If you get your insurance through your employer, your company’s online benefits portal is a great place to start.

- Open enrollment documents: The documents you receive during open enrollment often detail all the benefits included in your plan.

- HR department or benefits administrator: Your Human Resources department or benefits administrator can provide specific information about your coverage.

- Insurance provider website: Most insurance companies have a comprehensive website where you can review your plan details, find covered services, and learn about additional benefits.

1. Use Your Insurance Provider’s Resources

Your insurance provider is your primary resource for understanding your benefits.

- Online Portals & Apps: Many insurers, such as UnitedHealthcare, provide online tools and mobile applications. These platforms can help you locate in-network providers, review your plan’s details, and even track claims.

- Member Services: The member services number on your insurance ID card is your direct line to understanding your benefits. Call them to get clear information on your specific benefits, including co-pays, deductibles, and any prior authorization requirements for services. This step is crucial for avoiding unexpected costs.

2. Find In-Network Providers

To maximize your coverage and minimize out-of-pocket costs, it’s essential to find providers who are part of your insurance plan’s network.

- Use your insurer’s online provider search tool. This allows you to find mental health specialists and therapists who have agreements with your insurance company, ensuring you receive the highest level of coverage.

3. Consider Virtual Care

The landscape of healthcare is continually evolving, and virtual care has become a significant asset for mental health.

- Many mental health providers now offer virtual appointments via phone or video. This can be a highly convenient and accessible option for receiving care, especially if transportation, geographical location, or scheduling conflicts are a challenge. Virtual care can help bridge gaps in access to essential services.

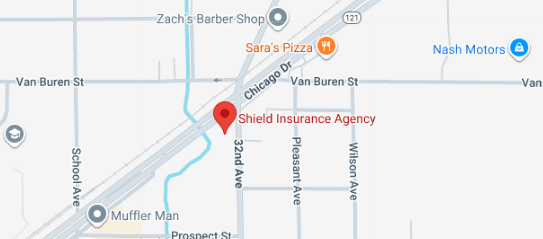

Contact us,

Call or Text : 616-896-4600

Fax : 616-896-4601

Email : ContactUs@shieldagency.com

Hudsonville Main Office Hours

Monday – Friday : 8:00 AM – 5:00 PM

We invite you to visit us on Facebook, Instagram, and LinkedIn.